STRATEGIC INNOVATION REQUIRES STRATEGIC CAPITAL.

INVESTING IN DISRUPTIVE NATIONAL SECURITY TECHNOLOGIES

We’re not a traditional VC — we’re national security end-users and trusted business leaders operating at the intersection of innovation and investment. We don’t invest in technology — we invest in the founders, companies, and capabilities vital to our security and prosperity.

A GENERATIONAL OPPORTUNITY FOR INVESTING IN DUAL-USE IS EMERGING.

[ 01 ]

CAPITAL INFLOWS INTO SECURITY TECHNOLOGIES AMID A SHIFTING GEOPOLITICAL LANDSCAPE

The steady rise of geopolitical instability is fueling a long-term secular trend in increased security technology spending as governments seek to meet 2%+ defence spending targets.

[ 02 ]

A NEW PARADIGM IN GOVERNMENT & PRIVATE SECTOR RELATIONSHIPS

Speed, flexibility and innovation are driving major structural changes in government procurement creating enormous opportunities for emerging and agile technology focused companies.

[ 03 ]

INNOVATIVE DUAL-USE TECH AMPLIFIES ADDRESSABLE MARKET

Technology related to AI and data infrastructure, cybersecurity, robotics and communications are dual-use, expanding beyond national security applications to new markets.

The private sector, rather than the government, is the wellspring of modern innovation, creating the technologies that will solve present and future defence and security challenges.

Venture-backed companies are increasingly outpacing incumbent companies in the development and implementation of disruptive technologies. Private sector technology innovation has become a vital element of our national security.

INVESTMENT THEMES //

Our investment strategy is designed to balance deep conviction with diversification across stage, geography and theme to manage risk while seeking capital appreciation.

-

Modern defence and critical infrastructure supply chains are being reshored and restructured to reduce reliance on fragile global production networks. Automation, additive manufacturing, and AI-driven production systems enable faster output, lower cost, and improved resiliency in mission-critical manufacturing environments. As governments modernize industrial bases and primes demand dependable suppliers, venture-backed manufacturing platforms can capture long-duration contracts, embed into procurement ecosystems, and scale into broader industrial markets.

-

Aerospace is entering a new era driven by rapidly declining launch costs, miniaturization, and growing demand for persistent intelligence, surveillance, and reconnaissance. Space-based infrastructure is becoming a core layer of modern defence capability, alongside communications and positioning systems that are increasingly contested. As allied governments expand space budgets and commercial markets mature, dual-use aerospace companies can scale across defence and civilian applications—creating strong acquisition potential and venture-scale outcomes.

-

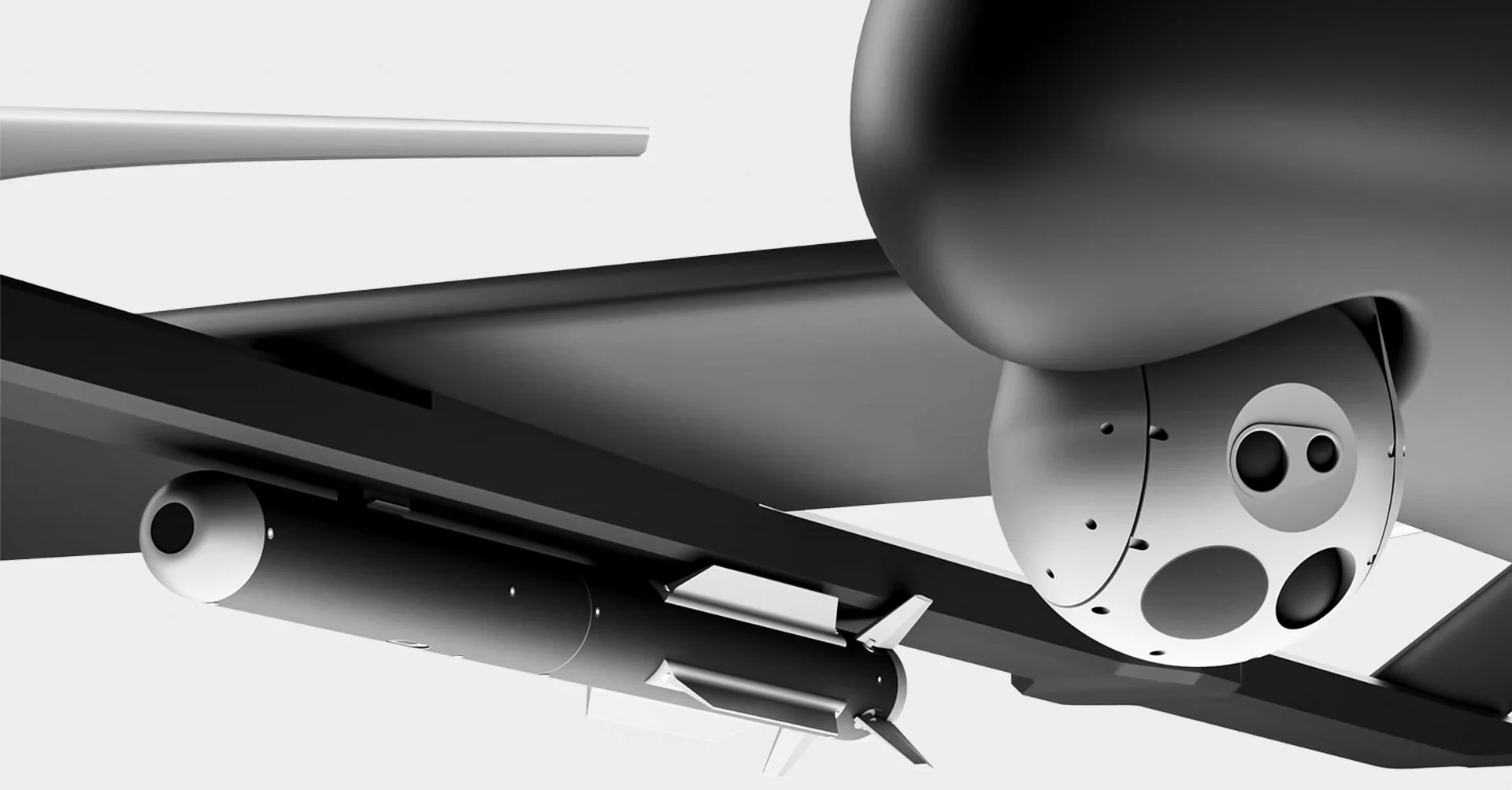

Autonomous systems are becoming central to modern defence strategy as nations prioritize force multiplication, reduced personnel risk, and scalable operational capability. Advances in AI, sensing, and low-cost hardware are accelerating the deployment of autonomous platforms across air, land, and maritime domains. These technologies are also directly transferable into industrial markets such as logistics, inspection, and resource extraction—creating large addressable markets with multiple commercialization pathways and durable demand.

-

Defence and national security organizations are shifting from hardware-centric capabilities to software-defined systems where data dominance drives operational advantage. AI-enabled analytics, decision support, and real-time intelligence platforms are increasingly critical as the volume and complexity of sensor data grows. Software-first models also enable faster iteration cycles, scalable deployment, and recurring revenue structures—making AI one of the most compelling areas for venture-backed value creation in the defence and dual-use ecosystem.

-

Energy grids, transportation systems, ports, and industrial facilities are facing growing physical and cyber threats, while modernization efforts expand the number of connected systems and exposed vulnerabilities. Governments are prioritizing resilience as a strategic necessity, driving sustained investment into monitoring, hardening, and rapid-response capabilities. This creates long-duration demand cycles for technologies that protect critical systems, with scalable commercial overlap across utilities, industrial operators, and regulated infrastructure providers.

-

Cybersecurity remains one of the most durable investment opportunities in the defence and dual-use landscape, driven by accelerating state-sponsored attacks and the expanding digital footprint of governments and enterprises. Security spending continues to grow regardless of economic conditions as cyber risk becomes a board-level and national-level priority. With recurring revenue models, high-margin scalability, and consistent strategic acquisition demand, cybersecurity continues to produce strong venture outcomes across both public and private markets.

-

Secure connectivity is becoming a foundational requirement for modern defence operations and critical infrastructure as devices, sensors, and distributed systems proliferate. Edge computing, resilient networks, and secure communications architectures are essential for operating in contested environments where reliability and security are mission-critical. Companies that control connectivity layers and secure device ecosystems can capture long-term platform value, with commercialization opportunities spanning defence, industrial automation, transportation, and energy markets.

-

Quantum technologies represent a long-duration frontier with significant strategic importance, as governments and major institutions invest heavily in next-generation computing, sensing, and encryption capabilities. While timelines vary, the potential impact across defence, intelligence, and advanced industrial systems is transformative. As the ecosystem matures, quantum-driven breakthroughs in sensing, secure communications, and optimization create high-upside opportunities with strong strategic demand and asymmetric return potential.

INCLUDING BUT NOT LIMITED TO:INVESTMENT PORTFOLIO

-

Advanced and cost-effective counter-uncrewed aerial systems (CUAS) solutions

-

End-to-end data collection and analysis for critical infrastructure & more.

-

Industry-leading AI, data, & insights to support mission-critical space training, planning, and operations.

-

The world's smallest, lightest, most cost-effective tactical communications system.

-

Cost-effective, scalable drone detection for everyone.

-

Multi-domain, command and control solutions for unmanned systems.

-

Revolutionizing the way companies, governments, and research institutions protect their intellectual property.

We don’t invest in technology — we invest in the founders, companies, and capabilities vital to our security and prosperity.

Our investment philosophy prioritizes responsibility, diversification, and commercially driven innovation.

National security and defence-related technologies now form a meaningful component of the broader innovation and infrastructure landscape. While we may invest selectively in companies with a primary defence or national security focus where aligned with our investment thesis and risk framework, our strategy remains diversified and primarily oriented toward commercially driven and dual-use technologies.